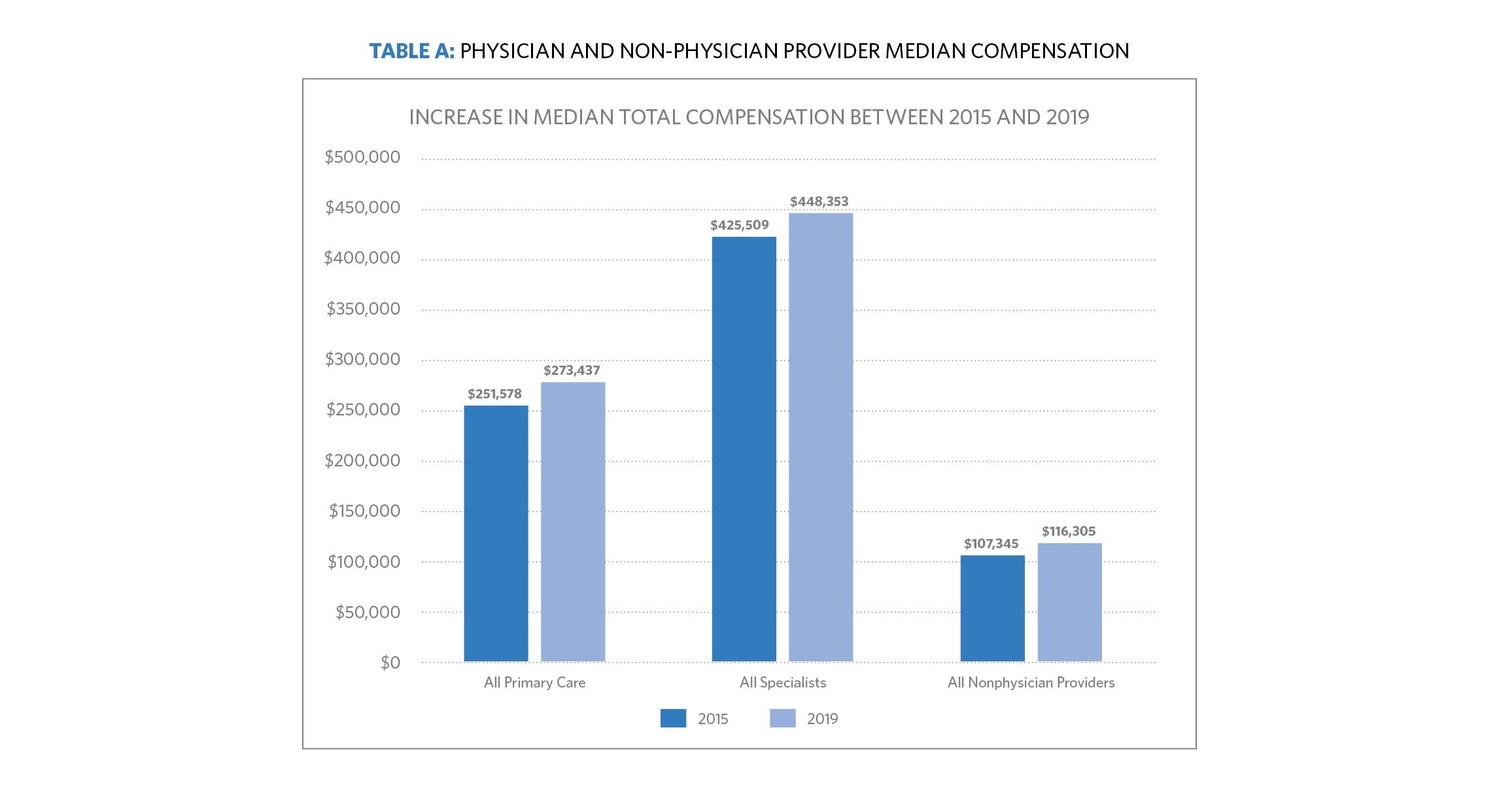

Primary care 2019: 273000

/PRNewswire/ -- Medical Group Management Association (MGMA) released its 31st annual Provider Compensation and Production Report, the most comprehensive view...

www.prnewswire.com

Primary care 2023: 298000

www.mdlinx.com

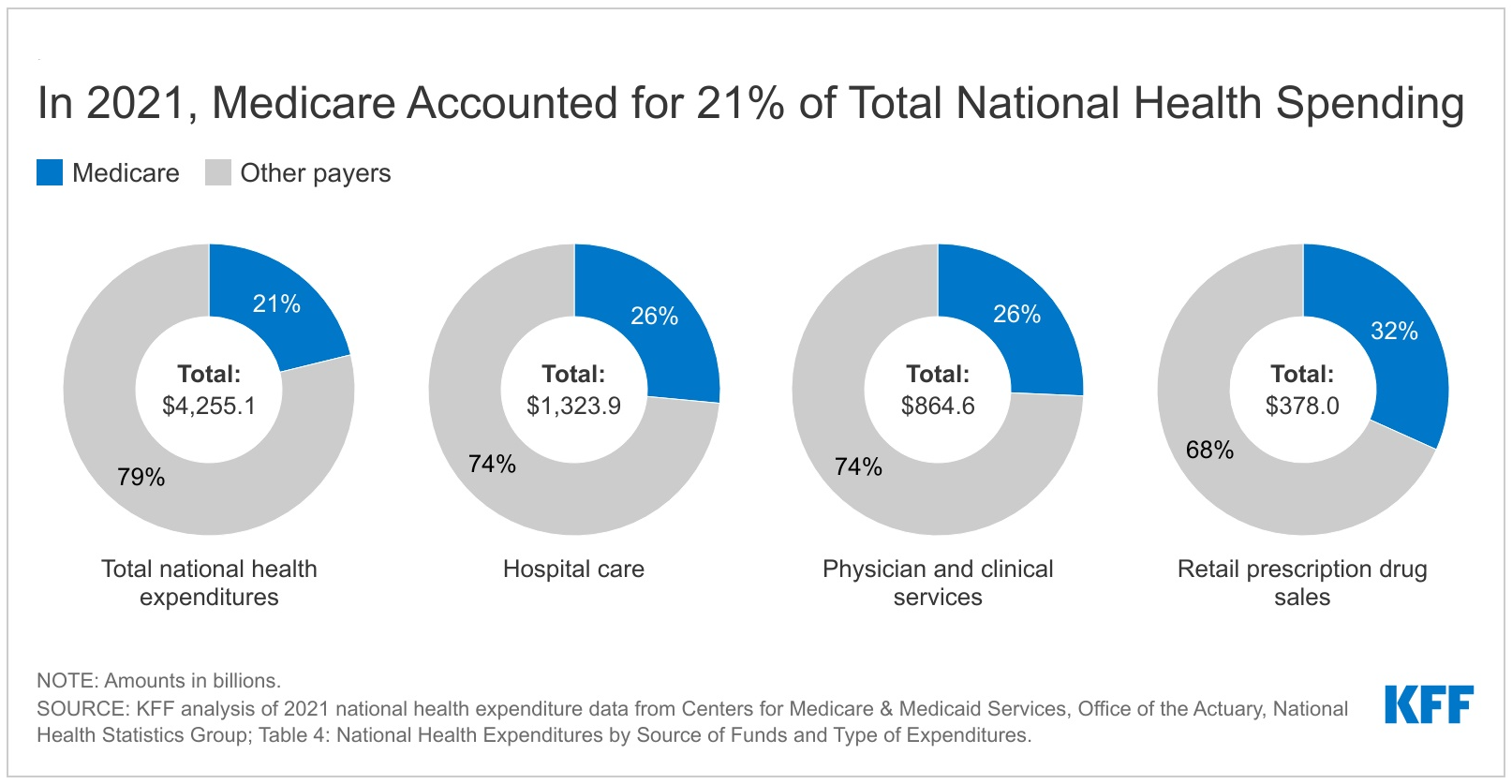

Anything else? This isn’t just about physicians, and it’s not just about anesthesiologists within physicians.

No matter how many ways the .gov folks massage the numbers to meet their political goals, the people aren’t buying it. That includes both liberal and conservative people that I know.

If a party can’t convince people that what they see in their daily lives isn’t real, then their data either isn’t true or their arguments suck. Either way, people aren’t buying it and there will be a consequence for that.

I don’t buy it. And I don’t care what’s happening in even more poorly run, more liberal countries. I care that it costs double to get across the country than what it used to and the planes are late more. I don’t need some twit on a .gov site to tell me that I’m just fooling myself.